Bitcoin: A Distinct Asset Class with Gold Divergence

Discover why Bitcoin stands as a distinct asset class and explore its correlations with various financial instruments, as highlighted by analyst James V. Straten. Uncover the potential benefits of Bitcoin's independent nature and its implications for portfolio diversification. Plus, gain insights into the future of Bitcoin's correlation with equities and other developments in the cryptocurrency sphere.

Bitcoin's Unique Position

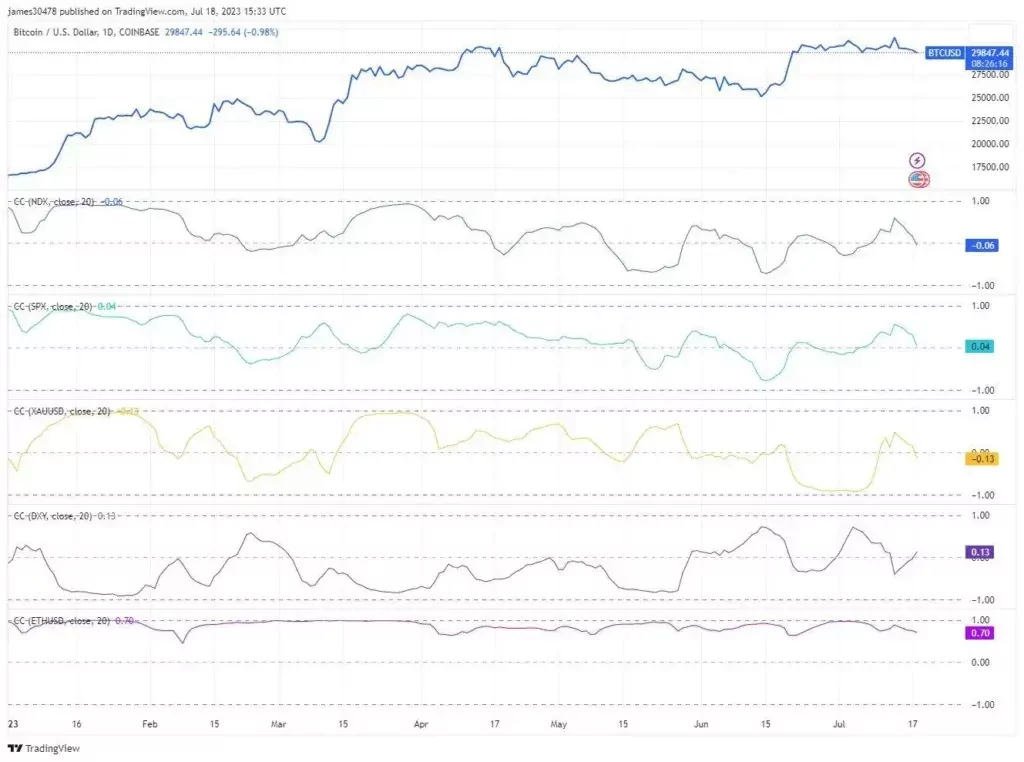

A recent study conducted by analyst James V. Straten and shared on Reddit on July 21 examined the correlation between Bitcoin and traditional trading instruments. The findings revealed that Bitcoin is a distinct asset class, displaying weak or negligible correlations with major traditional financial assets like equities and precious metals.

Breaking the Mold

Unlike other assets, such as gold and the S&P 500, which demonstrate negative correlations with Bitcoin, the digital currency diverges from these traditional options. The correlation figures between Bitcoin and the S&P 500 and gold stand at -0.05 and -0.12, respectively. Conversely, Bitcoin displays a positive correlation of 0.70 with Ethereum, suggesting a closer relationship between these two cryptocurrencies.

Implications for Bitcoin Investors

Bitcoin's distinct nature as an asset class can have significant benefits for investors. The cryptocurrency's weak correlations with traditional financial assets suggest that under ordinary market conditions, Bitcoin's performance is not heavily influenced by the volatility of other assets, such as stocks and precious metals.

This decreased correlation makes Bitcoin an attractive option for diversifying investment portfolios. Investors looking to reduce risk and explore new avenues for potential growth can consider adding Bitcoin to their investment strategy.

The Future of Bitcoin-Equities Correlation

The correlation between Bitcoin and equities may continue to decline in the coming months, driven by recent developments in the cryptocurrency sphere. Major financial institutions like BlackRock and Fidelity have filed for spot Bitcoin ETFs, sparking optimism and increased investor interest. While the United States Securities and Exchange Commission (SEC) is yet to approve a spot Bitcoin ETF, the potential approval could lead to further reductions in correlation and support Bitcoin prices.

While the reduced correlation with traditional assets presents a positive outlook for Bitcoin, analysts remain cautious about potential macroeconomic factors that could impact prices. Monetary policy changes and other external influences could still affect Bitcoin's performance. However, the long-term outlook for Bitcoin remains optimistic due to its deflationary nature and increasing adoption. In Q2 2024, the Bitcoin network will adjust its emissions, increasing scarcity and potentially driving future growth.